In the first part of this two-part primer we drew on our IDA support experience to map out the contagion routes created when a DevCo[1] is established.

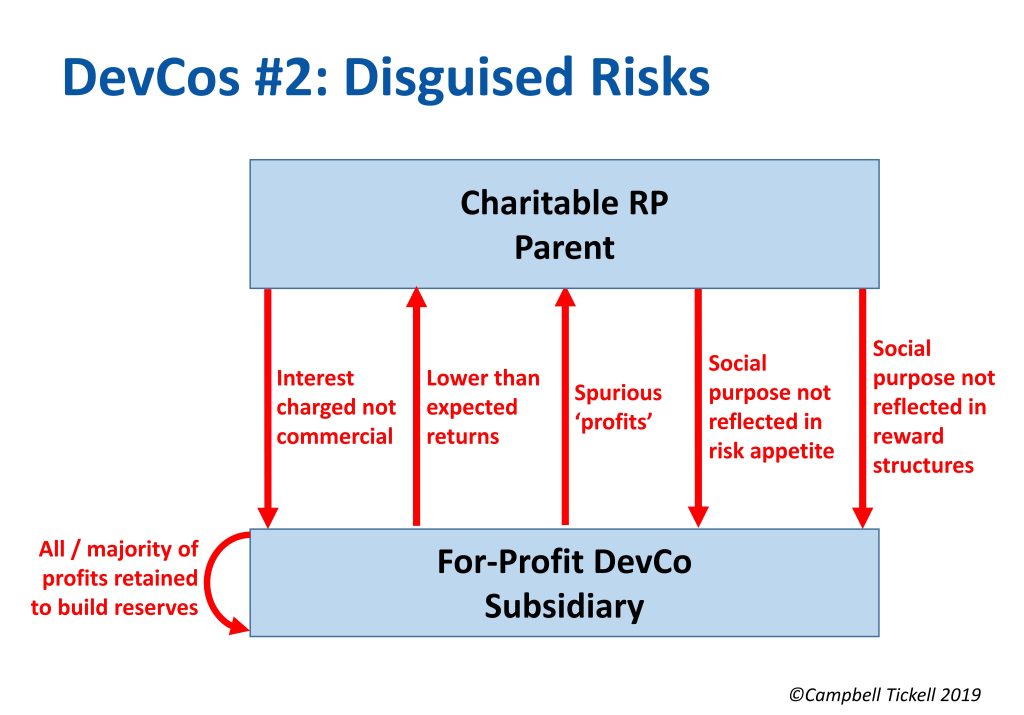

In this second part we take a closer look at hidden or disguised risks, and some of steps that RPs can take to ensure that their risk management framework evolves to adequately control new DevCo hazards.

Commercial interest rates

Investment by a charitable housing association in a DevCo is governed by charity law. Charity law states, among other things that investments should achieve “the best financial return within the level of risk considered to be acceptable.” Once organisations step outside the relatively simple activity of investing surplus cash in appropriately secure institutions, Boards need to seek assurance that the rates of return on those investments are appropriate. Whilst the interest charged to a subsidiary does not need to equate to the full commercial rate that a speculative builder might pay on its borrowing, (because of the greater degree of control and transparency that the parent Board enjoys), it does need to reflect the risks involved in the activity that is being funded. This interest rate will be higher than the RP’s cost of capital, and independent professional advice should be sought in order to scope an investment policy and to determine appropriate repayment terms and interest rate margins.

Lower than expected returns

With the passage of time, it can be easy to lose sight of the original reasons for establishing a DevCo and undertaking market sale. Those will have included the generation of cross-subsidy to support the core business. In doing so scarce resources will have been diverted from charitable activities in the expectation of returning higher amounts at a later stage. Whether the rates of return were explicit or implicit at the time decisions were made does not detract from the fact that lower-than-expected returns represent a risk crystallisation, as well as an early sign of potential mounting problems. This underlines the need for an investment policy that clearly sets out expected rates of return, as well as close and ongoing performance monitoring by the parent.

Building reserves

Another oft-observed step in the development of a DevCo is the moment when the subsidiary Board asks to retain some of its profits to build up its own reserves. This is justified in terms of supporting additional third-party borrowing, avoiding on-lending limits and producing higher profits to be returned to the group at some unidentified point in the future. At its worst this sets up a hamster wheel of an argument, where-by growth in the DevCo absorbs all its profits and the returns to the parent only occur when it ceases to develop. At best this once more diminishes the initially anticipated returns, a change in outcomes which is often over-looked at the time of the retention decision.

Spurious profits

We have also seen DevCos being used to undertake certain activities on behalf of the parent for a fee, (such as project managing social housing development). This needs to be treated with great care as it creates considerable opportunity for obfuscation, particularly if the ‘margin’ charged on those services enhances or creates the DevCo profits that are subsequently gift-aided back to the parent. This is delusional nonsense and can further disguise lower than anticipated returns whilst being quite hard for Boards to spot.

Private sector risk appetite and incentives

Deliberately setting up a DevCo at arms-length to the RP in order to foster hard-nosed commercial approach can result in heightened risk taking that may be hidden from the parent Board’s sight. Independent NEDs on a DevCo Board may well bring valuable private-sector experience, but may also struggle to grasp the full implications of the social objectives of the group and the regulatory constraints within which it operates. This can result in conflict over how the group’s risk appetite fits with the DevCo’s ambitions.

Furthermore, where key executives leading the market-sale activity are recruited from the private sector with private sector-style incentive packages, such individuals can stand to benefit enormously from the upside of taking more market risk, with limited downside. A downside that could include losses to the RP parent which would divert resources from the social objectives, and which may even result in social housing units being lost to the sector. At worst this creates a form of moral hazard.

Enhancing controls

Setting up a DevCo may well be the right and best thing for an RP to do, despite these various cautions and strictures. We have set out above some fundamental errors that RPs should avoid. More proactively, there is a range of controls can ensure that any parent Board actively manages the risks of the DevCo. These include:

- Seeking independent, professional advice to shape an investment policy and to benchmark on-lending terms and margins;

- Negotiating impairment-neutral parent loan covenants;

- Developing a suite of well-calibrated golden rules that explicitly control and cushion the on-lending / financial assistance limits, cash-flows and potential impairments embedded in the DevCo;

- Building parent and DevCo base business plans and cash-flow forecasts that demonstrate compliance with those golden rules;

- Stress-testing the domino effect of a housing market shut-down, first on the DevCo and then ricocheting through the contagion routes to the RP and the social housing assets;

- Using the results of those stress tests to re-calibrate the golden rules to articulate the most appropriate risk limits;

- Ensuring that the key investment and development decisions are made in the parent (at executive or Board level depending on delegations) rather than in the DevCo, and that the relevant golden rules are hard-wired into those decision-making processes; and

- Strengthening NED and Executive induction programmes to ensure that those with valuable private sector experience are able to quickly adopt the social objectives of the group and understand how they necessarily limit the risk appetite of the DevCo.

To ensure an indigestion-free 2019, Boards must revise their risk management frameworks to deliver close oversight of their DevCo’s diet.

[1] An RP subsidiary created to carry out market sale for profit

To find out more contact Sue Harvey on +44 (0)20 8830 6777 or email sue.harvey@campbelltickell.com

This article originally appeared on socialhousing.co.uk