The rationale for registered providers’ increasing involvement in commercial activities, such as build for sale, needs little explanation. Housing associations have for many years sought to replace dwindling capital grant with cross-subsidy from profit-generating activities, in order to sustain the development of affordable homes.

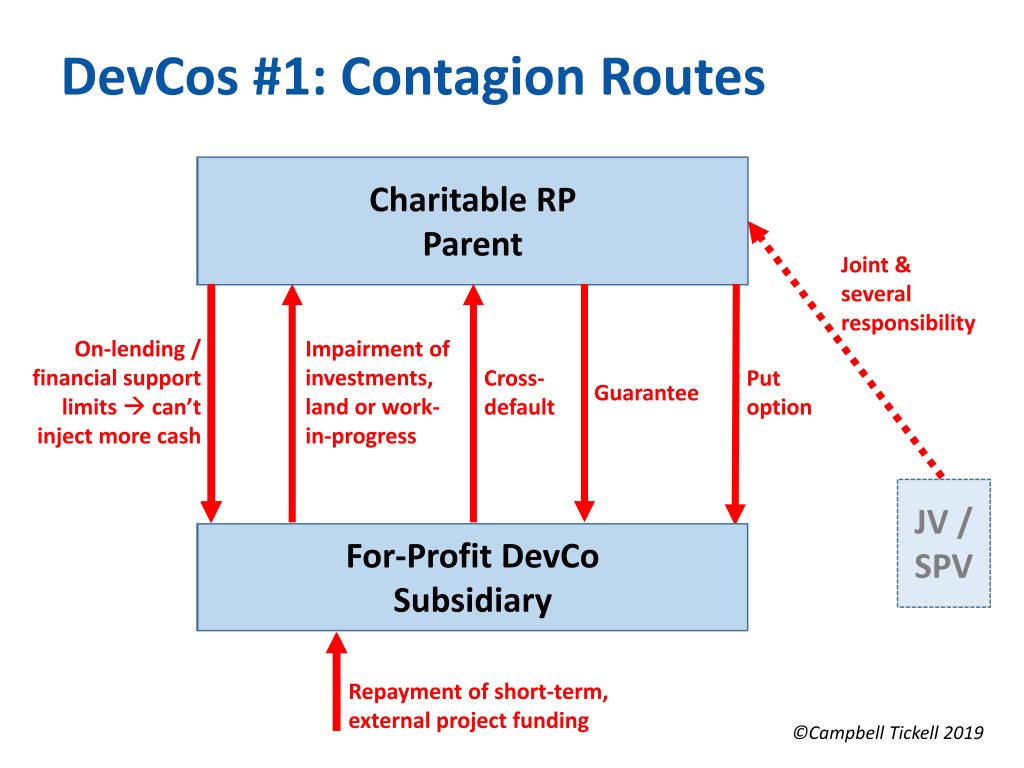

Tax issues and charitable rules have seen a proliferation of for-profit development company subsidiaries (‘DevCos’ for short) to carry out these market-facing activities. Boards have also often been persuaded that a DevCo has the additional advantage of ring-fencing market risk. However as shown in some recent cases and depending on how they are governed and funded, DevCos can in some cases, create contagion routes for exposures to flow back to the RP, as well as magnifying or disguising other risks.

In this primer in two parts we reflect on lessons drawn from our In-Depth Assessment (IDA) support experience, which includes scrutinising over 50 sets of stress tests and group structure charts. In doing so we map out some of the ways in which existing risk management frameworks may be challenged by the creation of a DevCo. In this first part, we take a look at those contagion routes, whilst in part two we will examine hidden or disguised risks, and some steps that RPs can take to ensure that their risk culture and processes evolve to adequately control DevCo risks.

With an eye to these contagion risks, the Regulator of Social Housing (RSH) has made the exploration of group structures central to its IDA process. In Regulating the Standards RSH sets out its intent to focus on “the interaction between the provider and the various organisations connected to it [and] how risks flow between them”. The Sector Risk Profile duly urges that “Boards must assure themselves that a ring fence is secure”.

The number and bandwidth of those contagion routes depends in part on whether the DevCo is wholly intra-group funded, or if it has its own external sources of funding.

Intra-Group DevCo funding

Most DevCos are funded by way of on-lending or equity investment from the RP parent. For those organisations the constraint on capacity and first contagion route may well be the financial assistance limits set within the parent’s loan covenants. (To simplify things these are often referred to as on-lending limits, overlooking that the wording in the loan documentation may also encompass equity investment and guarantees). When things start to go wrong, organisations quickly discover that those constraints turn out to be pretty hard boundaries, blocking them from getting much needed cash into a struggling DevCo.

The second contagion route is via the potential for impairment of the assets in the subsidiary, including debt, land and work-in progress. Should it prove impossible to convince the external auditors that the full value of those assets is realisable, and/or that the debt can reasonably be expected to be repaid, an impairment charge in the subsidiary’s accounts may need to be made and will flow through to the parent’s Statement of Comprehensive Income on consolidation. If any of the parent’s interest cover covenants are not neutral to this non-cash item/charge, covenant compliance issues in the parent may arise.

Externally Funded DevCos

Additional contagion routes, which can magnify risk considerably, are created when DevCos look for external funding to replace or augment the usual in-house on-lending. This step often occurs as DevCos mature, as the appetite of the parent grows and/or as it becomes evident that commercial development of housing for sale is capital hungry.

Chief amongst these, and our third contagion route, is cross-default risk. Where problems mount to such an extent that a DevCos’ third-party lenders call in their loans, the impact will ricochet through the cross-default clauses in the much larger parent loans. Such a risk may initially seem remote, but a DevCo funded with short-term project finance and reliant on inflows of cash from sales, can be extremely vulnerable to adverse changes in market conditions. Not least because implicit in this cross-subsidy business model is the distribution of any reserves back to the parent as gift-aid, leaving very little fat in the subsidiary to absorb adverse variances.

This absence of ‘fat’ means that external funding for DevCos usually requires support in some form or another from the parent. This can inadvertently lead Boards to open a direct contagion route to the RP’s social housing assets. Indeed, the very comfort that funders are seeking is the assets that the regulator expects RP Board’s to protect. Because guarantees are often caught by restrictions on granting financial assistance, they are occasionally reconfigured as ‘put options’, whereby the parent commits to acquire any unsold units at the lower of cost or market value if market conditions threaten the repayment of the third-party funding. Since those purchases will necessarily not be at a time or value of the RP’s choosing, they still represent a contagion route to the social housing assets, and the regulator will view them as disguised guarantees. Any such guarantees or options must be set out in the Asset and Liability Register and integrated into stress testing.

Other contagion routes that are not directly associated with DevCos are those linked to Joint Ventures and Special Purpose Vehicles, both of which bring third-party funding into a connected legal entity. The regulator expects Boards to seek assurances that JV-created ring fences are secure in the same way that it does for DevCos. And it further urges that due-diligence should identify any counter-party risks in this regard. Some JVs or SPVs, particularly those associated with long-term or large regeneration projects, may involve a form of joint and several responsibility for the liabilities of the vehicle. In this type of arrangement, it is very often the case that the housing association is the party with the deepest pockets meaning that if the JV were to get into difficulties or fail, the RP could find itself responsible for liabilities that far exceed its original investment. It is clearly important that such contingent liabilities are accurately recorded in the Asset and Liability Register of the Parent.

With such a variety of dominos and ricochets, the combination of housing markets softening and Brexit looming means that there is no better time for Boards to reduce their vulnerability to DevCo contagion. In part two of this primer we will look at some of the control mechanisms that do just that.

To find out more contact Sue Harvey on +44 (0)20 8830 6777 or email sue.harvey@campbelltickell.com

This article originally appeared on socialhousing.co.uk