It’s over three years since the referendum and we still don’t know how Brexit will happen and on what terms, or even perhaps whether it will happen. This doesn’t help businesses that need to plan for not just the next few months, but for years ahead.

What are the risks, and how can providers and developers of housing and of care services manage them?

This blog will not attempt to cover all the challenges, but it does offer pointers.

Regardless of your view on the advantages or disadvantages of Brexit (and this article does not take a position pro- or anti-Brexit), if you judge that your business is likely to be affected, you should be prepared for potential eventualities. All agree there will be significant change, and it could come quite suddenly if we leave the EU without a trade deal in place. As ever, effective risk management is about considering and anticipating what might happen, in order that robust planning and potential mitigations are in place in case it does.

Critical areas liable to be affected include: people, supplies, logistics and money.

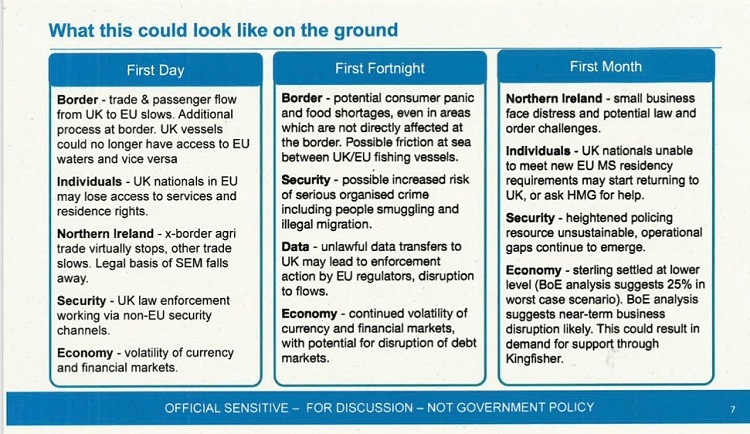

Here is what an internal Whitehall briefing (obtained by Sky News) identified could happen in the first month following a no-deal exit from the EU.

What are the potential risks?

What are the potential risks?

In terms of the economy as a whole, there are fears that sterling would crash in a no-deal scenario, some estimates suggesting that its value could drop to parity with the US dollar. This in turn would mean heavy inflation on imported goods, such as petrol, construction materials and medical supplies. Interest rates too could increase, affecting borrowing.

While some trade deals could be done in relatively short order – and some have already been negotiated by the government – these have not thus far been with significant UK trading partners (and it is worth bearing in mind that across the economy, some 45% of British exports go to the EU). Experience shows that trade deals take a long time to agree (on average it takes 45 months to agree and implement a trade deal).

There are fears that the current slowdown in the housing market might turn into a full-blown crash. This could mean developers land-banking; builders stopping building; and housing association cross-subsidy no longer working.

The construction and maintenance sectors could be affected by EU (and other) workers feeling unwelcome and heading home – or to more fertile pastures. The effects could be significant: across the UK, c.9% of construction workers are understood to be from the EU; in London, the figure is reckoned to be c.24%. Components meanwhile could be subject to rising costs and import delays. 60% of construction materials come from the EU, including over 90% of the soft woods used in housebuilding. And while modular construction is on the rise (from under 2% of new housing output), it will be unable to make much difference in a short time.

The social care sector could be affected by staff shortages in the same way as construction and maintenance. Supplies of medicines and consumables too could be affected. It isn’t of course simply finished goods that matter here: a majority of UK imports and exports comprise goods or services that are themselves inputs into production; so the strength of your supply chain will be critical. More widely, there is counterparty risk: it isn’t just the strength of your business that matters, it is the strength of your partners, contractors and suppliers too, which can be harder to establish and predict.

For social landlords, business plans could be hit; for instance, if inflation rises and is sustained at high level, where will this leave the government’s commitment to return to allowing rent increases up to CPI plus 1% annually – costs will increase, but rents may not rise at a similar level. And what might be the effects for supported housing costs?

Meanwhile, logistical problems could prove a significant challenge for some organisations, affecting materials supply, staff mobility and service delivery in areas such as Kent, should there be disruption and delay at cross-channel ports, and in Northern Ireland too, if a hard border is put in place.

While it appears likely that there would be a post-Brexit public spending boost, it is less clear how long it would last. Some commentators anticipate that it could peter out after about six months. Certainly, if the economy is adversely affected by Brexit, and unemployment rises, the Chancellor’s tax-take – and hence funding available for grant and investment – can be expected to decline. Moreover, those expecting a big boost for social housing providers are liable to be disappointed: ministerial pronouncements suggest that new money is likely to be focused on home ownership and private developers.

It is unclear at this point what might be the effects on investment in housing. UK institutional investment appears buoyant at present, as does foreign investment, and that may continue, not least because if sterling falls in value, overseas money has greater purchasing power. This could be tempered, however, if there is a sense of political risk.

It seems perfectly possible that Brexit – a no-deal Brexit in particular – will cause more personal economic hardship for many. Brexit advocates have acknowledged as much. This is likely to mean more people turning for help to their local councils – which are themselves cash-strapped – as well as local organisations such as housing associations and charities. Even with the potential for more employment opportunities in sectors where EU and other workers have opted to leave, there is potential for increased unemployment in other sectors where businesses judge they cannot remain viable, much less grow.

More broadly, there is a strong sense that, following on from the current febrile political environment, political instability could become the norm, nationally and locally, with potential realignments affecting not just Westminster but local councils too. Much of this was on display in May’s local and European Parliament elections. Some fear civil unrest arising on either side of the Brexit divide, depending how the situation unfolds. This is not simply about political considerations: one might anticipate major customer dissatisfaction with underfunded or unavailable services.

Managing the risks – short-term

How then should social landlords, housebuilders and contractors, care providers and other affected organisations seek to manage the risks? I would highlight the following for consideration, according to the circumstances of your organisation:

- Ramp up the stress-testing of your business plan – what levers will you need to pull, what taps might you need to turn off, and at what points?

- Don’t just rely on Plan A; consider your Plan B and Plan C;

- Stockpile the critical materials and supplies you cannot do without;

- Increase your cash holdings to maximise liquidity;

- Consider whether to put spare cash into Euros or other currencies;

- Increase the frequency of credit-checking your suppliers and other counterparties;

- Consider increasing pay, or exploring golden handcuffs, for key staff;

- Know your workforce – and plan in case of potential departures;

- Lobby your MPs – directly and via your trade bodies, such as the NHF, CIH, LGA, CBI, HBF.

Managing the risks – long-term

Longer term too, there is much work to be done:

- Pursue or ramp up offsite modular construction;

- Focus on growing and developing your own staff, with apprenticeships and training schemes;

- Explore UK sources of suitable materials to replace those you routinely import;

- If relevant, establish or develop partnerships with businesses in the EU or elsewhere;

- If relevant, consider establishing subsidiaries in EU or other countries;

And above all, think laterally and creatively – for all that there may be challenges and disruption short term, new normals, new opportunities and new ways of operating will emerge.

Most of this is simple common sense, and in the context of a well-founded and regularly updated approach to risk, it will be what the great majority of affected organisations are already doing. But common sense also dictates that it is worth keeping these matters under close and continuing review, especially as we get nearer to a potential Brexit and the position becomes (hopefully) clearer. It may well be that many of the scenarios touched upon in this article do not come to pass, but then effective risk management is about identifying what could go wrong, and making sure (so far as possible) that if it does happen, you are prepared and can cope.

To discuss this article, contact greg.campbell@campbelltickell.com.