Image: Istock

Fraud Prevention

The new Failure to Prevent Fraud offence applies to housing associations. So, what should organisations be doing to actively prevent and detect economic crime?

RISK & ASSURANCE

Arun Chauhan

Director and Founder, Tenet

Arun Chauhan

Director and Founder, Tenet

Issue 81 | December 2025

The Economic Crime and Corporate Transparency Act 2023 (ECCTA) introduced a new corporate criminal offence: the Failure to Prevent Fraud Offence. This legislation marks a significant shift in the UK’s approach to tackling fraud, placing a proactive duty on organisations to prevent fraudulent activity. Crucially, housing associations are within scope of this offence, and leadership teams must take immediate steps to understand and mitigate the associated risks.

However, housing associations may be wondering: why are they in scope and what is the likely risk of being held liable for an offence?

What you need to know

The sector has always looked to do the right thing, regardless of risk of culpability and this law is no different. It aims to instill corporate maturity towards a wide definition of fraud risk.

Under ECCTA, an organisation can be held criminally liable if a person associated with it commits a fraud offence intending to benefit the organisation. Unlike other corporate criminal legislation such as the Bribery Act 2010, an ‘associated person’ under ECCTA does not need a contractual link to the organisation. This widens the risk considerably. For example, a sub-contractor of a supplier obtaining goods on the black market for repairs of your stock could expose a risk.

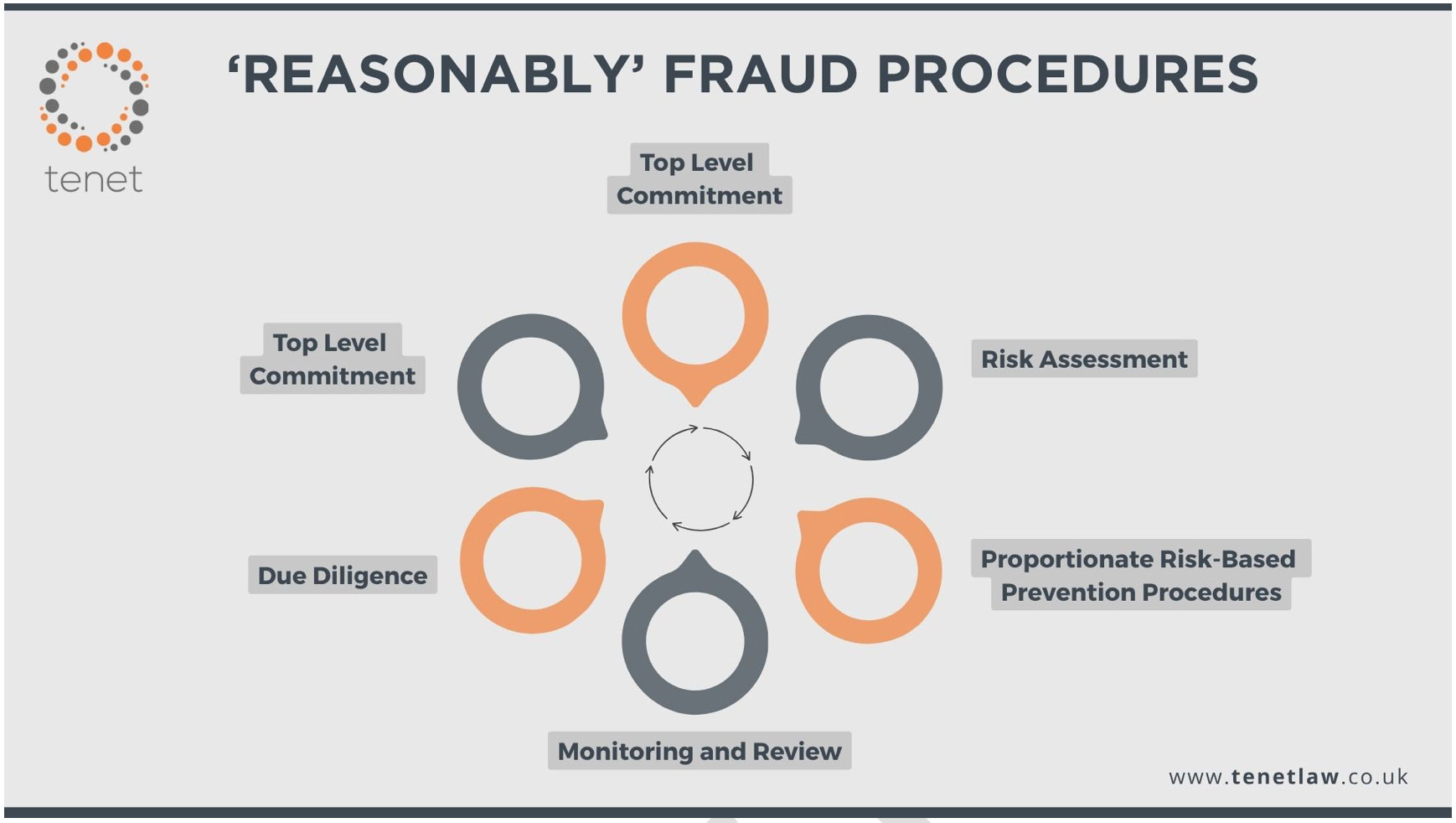

The only defence is to demonstrate that the organisation had ‘reasonable procedures’ in place to prevent such conduct. This is not merely a compliance exercise; it is a governance imperative. Like other areas of compliance such as health and safety, we cannot as a sector continue to discover this compliance risk (i.e. fraud) by chance. It requires a proactive approach to understanding fraud risk particular to your organisation, not just the sector as a whole.

Why housing associations are in scope

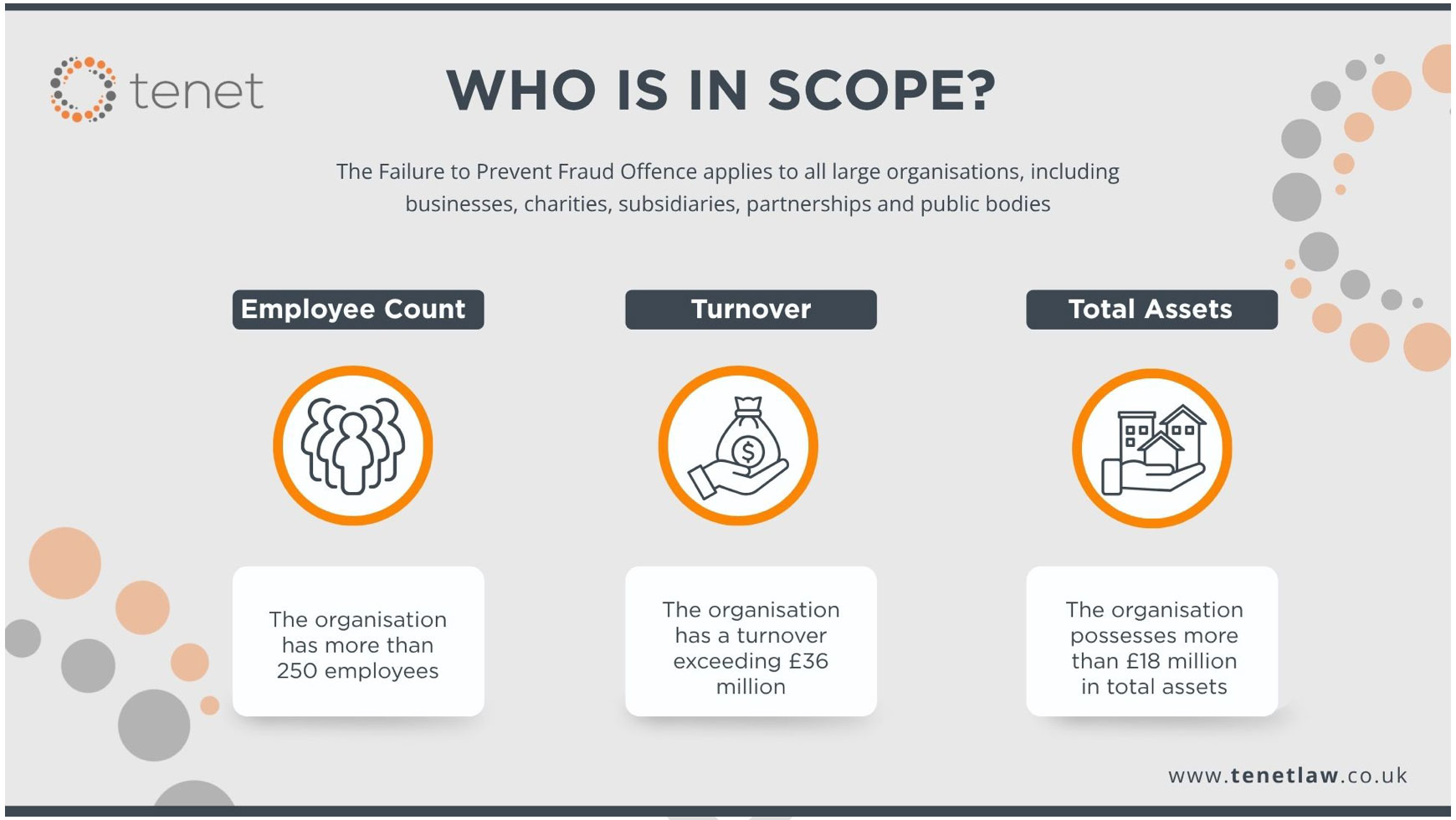

Housing associations, as registered providers of social housing, fall within the scope of ECCTA due to their corporate structure and public-facing operations. While traditionally seen as low-risk for financial crime, the reality is that housing associations manage significant assets and public funds, have an ecosystem that engages with a wide range of third parties and interact with vulnerable customers, all of which can expose them to an offence under ECCTA, if they tick two of the three criteria in the diagram above.

Fraud is defined by Schedule 12 of the ECCTA outlines covered offences, including:

- Fraud Act 2006: such as false representation, failure to disclose, and abuse of position.

- Proceeds of Crime Act 2002: in particular use of money generated through crime.

- Bribery Act 2010

- Theft Act 1968: such as false accounting.

The breadth of these offences means fraud risks can arise across operations, from procurement and ongoing contract management to rent collection, which can be linked to illicit tenant activity, and asset disposal.

Proactive approach

For leadership teams, this legislation strengthens not only the protection of public resources but also internal resilience against becoming victims of fraud themselves.

Tenet’s work with housing associations through fraud maturity risk assessments aims to instill a proactive approach to detection of fraud, engaging fraud risk champions, a conscious effort to improve input into operational risk registers and developing a true culture where leadership make realistic statements such as ‘we do not tolerate fraud’, rather than ‘we have zero tolerance to fraud’.

Organisations need to act on implementing adequate procedures through:

- Defining what fraud means within your organisation, endorsed at board level.

- Conducting a fraud risk assessment and mapping vulnerabilities across all business units and supply chains.

- Delivering targeted training (awareness and skills) to staff and contractors on recognising and reporting fraud.

- Implementing robust controls, particularly in procurement, finance, and housing.

- Maintaining trusted whistleblowing and channels to speak up, protecting those who raise concerns.

- Regularly reviewing and auditing fraud controls, adapting to emerging risks and regulatory changes.

- Seeking external assurance on the control framework implemented.

Wake-up call

In conclusion, the Failure to Prevent Fraud Offence should be a wake-up call for housing associations. Board members and leadership teams must lead from the front, ensuring that fraud prevention and detection are a strategic priority.

By embedding strong procedures and fostering a culture of integrity, housing associations can protect their stakeholders and fulfil their mission to serve UK communities with trust and transparency.

- Each year, Tenet and Newid publish best-practice white papers to help the housing sector respond to fraud and financial crime.

- Our latest white paper, shaped by discussions at October’s Housing Sector Fraud Risk Conference in Manchester (where Campbell Tickell’s James Tickell presented), can be requested here.

- To get in touch and learn more about Tenet’s ongoing work in this area, email Arun Chauhan.